Authors

Yi Sun

Sustainable companies continue to outperform the broader market, also during this crisis

Stock markets around the world have seen major volatility over the past few months as the COVID-19 pandemic gives way to ever-increasing uncertainties going forward. But amid this shock, publicly traded companies who take sustainability seriously seem to significantly outperform the markets across various geographies.

Based on empirical analysis, businesses in WBCSD membership who demonstrate taking environmental, social and governance (ESG) factors into account, beat the major stock exchange benchmarks for year to date ending on 30 October 2020. (Find the analysis per market below)

Though the world is collectively still in the early days of navigating and shaping the recovery from this crisis, we see WBCSD members having performed above average during the turmoil. The observed ESG outperformance is not surprising: more resilient (read: sustainable) companies are often better-managed companies. And the data adds to mounting evidence that these companies are proven to be less vulnerable to systematic risks and more resilient to shocks so far and are likely to be noticed and appreciated by investors, especially in times of crisis.

However, the WBCSD member group is biased towards large-cap multinationals, which may contribute to a certain level of the recent outperformance. Also, given the fairly short time periods studied in this analysis, ESG profiles of these companies are likely not the only factor driving their outperformance. Sustainable investments are most lucrative over the long-term, so it remains to be seen how this outperformance plays out over the next months and years.

At the same time, the finance sector is also building a more convincing investment case about ESG. New evidence continues to validate the rationale behind climate investments, sustainable equity funds and bonds. ESG considerations in investment processes can improve risk-adjusted returns and that consensus will improve investors’ behavior and decision-making going forward. From the $6.84 trillion-AUM giant Blackrock to a $26 billion fund in Helsinki, most investors believe today that what matters is the resilience of companies to shocks, and there’s real financial value to be gained from adopting an ESG strategy.

COVID-19 recovery will continue to dominate the global economic outlook for the foreseeable future. The coming phase will serve to further separate the leaders from the laggards. Now is the time to ramp up investment in managing ESG-related risks and opportunities.

WBCSD analysis per market

For the North America market, WBCSD analysts measured the performance of 31 shares of member companies listed on NYSE and Nasdaq. Under both bullish and bearish environments, WBCSD members delivered superior returns compared with the wider market. By the end of October, the WBCSD portfolio had outperformed S&P 500 Index by 18.8%, and was 15.6% higher than iShares ESG MSCI USA index.

These companies have so far demonstrated a greater capacity for resilience during volatile markets, quickly recovering from the crisis lows in a V-shape trend demonstrated by the green line in the figure.

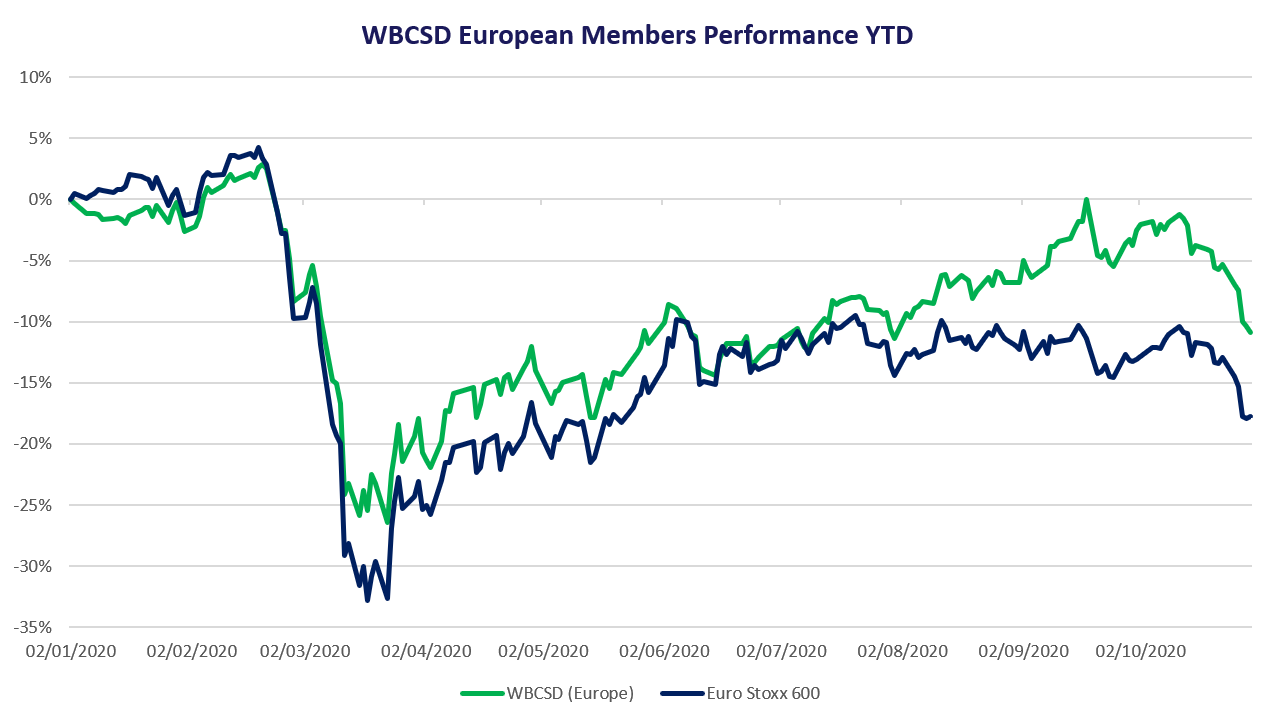

In Europe, the 67 listed member companies also weathered the downturn better and beat STOXX Europe 600 benchmark by a margin of 7%. The relatively strong performance of this group suggests investors’ interest and confidence in ESG factors as a defensive characteristic during the market’s slow recovery. The value of sustainable business is strengthened especially in the current time of crisis and uncertainty.

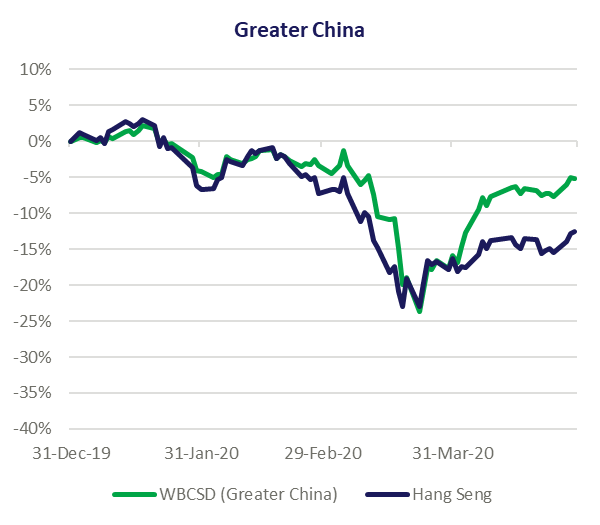

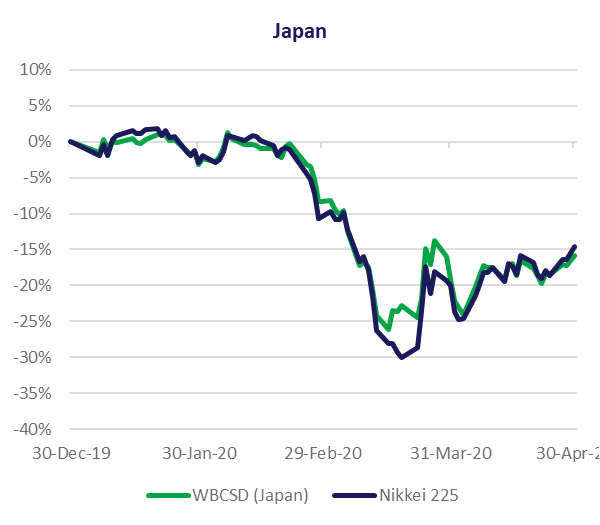

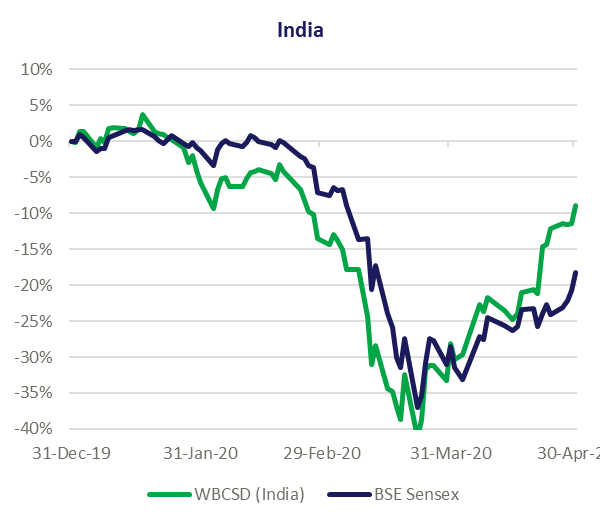

The performance of WBCSD’s Asian members also changed in line with their respective markets earlier this year. However, member companies in Greater China and India exhibited a higher level of momentum towards the latest recovery phase, outperforming the benchmarks by 7.5% and 9.4%, by the end of April. Japanese members mitigated the risks relatively better when the Nikkei index hit the year-to-date lowest level in March.

For more information:

- Yi Sun, Associate, Redefining Value

- WBCSD’s Investor decision making project

WBCSD news articles and insights may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Privacy Policy. All Content must be featured with due credits.

Related

Content

WBCSD and AICPA & CIMA publish a new Integrated Performance Management framework to drive strategy performance and engage workforces

26 October, 2023

The future of food – How Kraft Heinz is working toward and contributing to a more sustainable food system

17 October, 2023

TNFD releases proposed disclosure metrics for the forest sector

19 September, 2023