Authors

Inês Amorim, Senior Associate, Climate Action

Putting a value on greenhouse gas (GHG) emissions in a way that drives positive change is an increasing focus for organizations. Indeed, Internal Carbon Pricing (ICP) can be a powerful tool for incentivizing low-carbon decision-making, while helping companies meet external regulations, such as emissions trading systems. More than an information tool, an effective carbon price must be an integral element of decision-making processes, able to garner consistent buy-in from key stakeholders.

During a recent WBCSD climate peer problem-solving session, member companies identified three key challenges to address:

- Determining the optimal internal carbon price,

- Securing buy-in from key decision-makers

- Effectively using internal carbon pricing to reduce scope 3 emissions.

This article explores strategies to address these challenges and highlights the importance of using internal carbon pricing to achieve ambitious climate goals.

Setting the internal carbon price

Selecting the appropriate internal carbon price can be a complex task involving key decisions, such as determining the right price level, frequency of updates, and scope. Member companies highlighted the challenge of balancing a uniform price across contexts and projects, especially in the face of potential cap and trade schemes with varying prices across jurisdictions.

To overcome these challenges, it is crucial to define clear objectives and align the price with decarbonization targets. This can be achieved through a marginal CO2 abatement cost curve, ensuring that actions required to reach the ambition become cost-positive / cost-neutral at the prescribed level. A regional benchmark analysis of peers and regulations is also a useful exercise. To ensure the internal carbon price remains aligned with market dynamics, regulatory frameworks, and organizational goals, this benchmark should be regularly reassessed.

Another key challenge to consider is that, in many cases, the internal carbon price does not yet mirror actual external carbon regulations. Therefore, it is crucial that companies apply a progressive lens to the task and anticipate future regulatory and market changes. This defines corporate leadership and should be considered best practice.

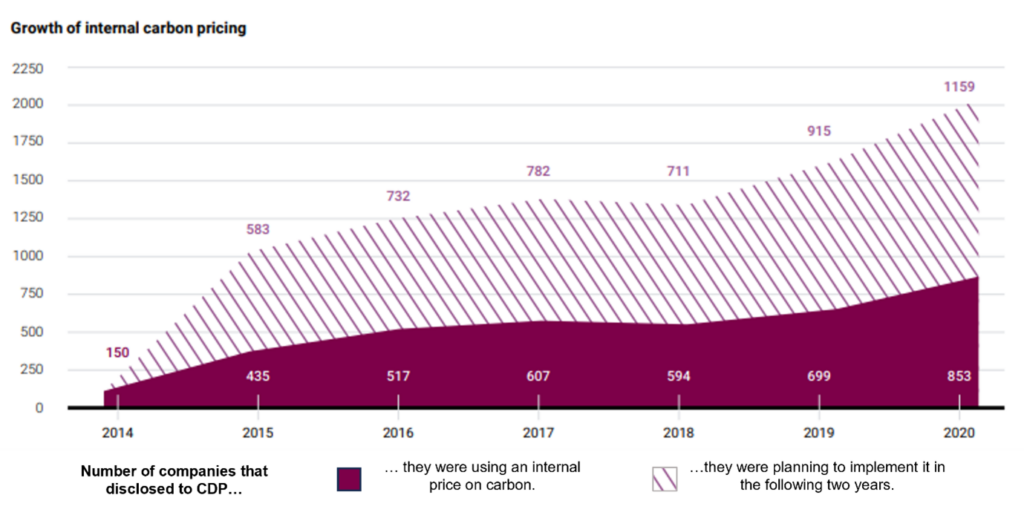

“Putting a Price on Carbon” (CDP, 2021)

Securing buy-in from key decision-makers

Gaining support from key decision-makers requires demonstrating the value of internal carbon pricing as it applies to different business functions, as well as the organization as a whole. Integrating the internal carbon price into existing processes and fostering inter-functional collaboration is essential.

To secure buy-in, conducting a business scenario analysis showcasing the anticipated CO2 price in the medium and long-term can be persuasive. Additionally, linking variable compensation targets to the implementation of the internal carbon price can incentivize senior stakeholders. Companies can further strengthen their case by demonstrating additional business benefits beyond CO2 reduction, such as Swiss Re’s use of internal carbon levies to fund the compensation of residual emissions through high-quality carbon removal projects.

Using internal carbon pricing to reduce Scope 3 emissions

Addressing supply chain emissions, beyond business travel, using internal carbon pricing presents unique challenges. To effectively incorporate carbon cost into decision-making, businesses should integrate the internal carbon price into procurement tenders, investment evaluations, and product development processes.

Starting with pilot projects focused on high-impact areas and scaling up, while prioritizing based on business value, is advisable. However, for internal carbon pricing to be truly effective in reducing Scope 3 emissions, it should be implemented alongside complementary policies, targets and effective carbon accounting, ensuring a comprehensive approach to emissions reduction.

Summary

By addressing these considerations and challenges, companies can design an internal carbon pricing strategy that drives decision-making, secures buy-in from key stakeholders, and effectively reduces both direct and indirect emissions throughout their value chains.

Further guidance for companies

- Carbon Pricing Leadership Report 2021/2022 (Carbon Pricing Leadership Coalition, 2022)

- Putting a Price on Carbon (CDP, 2021)

- The state of internal carbon pricing (McKinsey, 2021)

- 4 Ways Companies Can Price Carbon: Lessons from India (WRI, 2018)

Want to network with other organizations and find out more? WBCSD is currently developing a series of climate peer problem-solving sessions, where professionals can collaboratively address their climate challenges with like-minded peers in a supportive environment. For any questions on these sessions, please reach out to sos15@wbcsd.org.

WBCSD news articles and insights may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Privacy Policy. All Content must be featured with due credits.