Navigating the net zero transition

Unlocking business change

Purpose

This short introductory note is aimed at board level executives, senior management and professionals with a focus on sustainability, risk and change management. It explains the rationale for a company to plan for the transition to a net zero greenhouse gas (GHG) economy, the value of considering other social and environmental change simultaneously, and how such planning is enabled by ongoing business transformation and change management strategies.

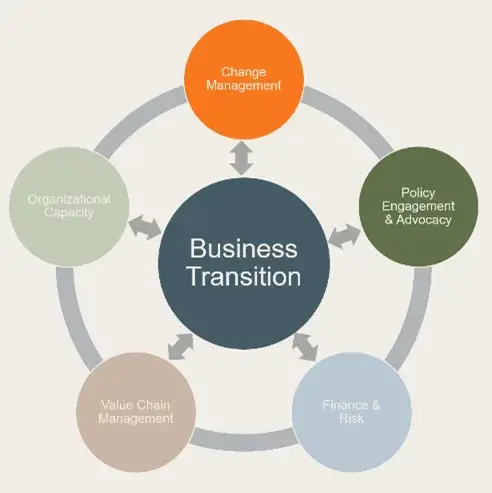

Building on the experience of companies in WBCSD’s Corporate Performance & Accountability (CP&A) Transition Planning Working Group and on wider member engagement during 2024, this note presents five key areas of focus for businesses to “unlock” the implementation of transition plans. Each of the areas is explored in an accompanying series of articles available here.

Context of Transition Planning

Climate change introduces inevitable environmental and societal change that affects business. Rising global temperatures initiate environmental hazards stressing the basic natural and social systems on which commerce relies. Many climatological hazards are already “baked in” to the coming decades from historic and current GHG emissions, and these hazards accelerate unless and until greenhouse gas (GHG) emissions sources are dramatically reduced and residual emissions are captured by sinks enabling a reaching of net zero emissions. Many public and private stakeholders, including a scientific consensus synthesized by the Intergovernmental Panel on Climate Change, regard achieving net zero carbon emissions specifically by mid-century (and other GHGs shortly thereafter) as the necessary timeline to stay within functional social and planetary boundaries. Efforts to achieve net zero through techno-economic, social or policy change have prompted a multi-decadal industrial transformation to decarbonize economies, the so-called “transition” to a net zero economy.

In many sectors and industries, the forces driving the transition are evident and have been accumulating for some time. An electric utility in any market, for example, faces a vastly different technology landscape than a mere decade ago because renewable energy generation has become so cheap to produce that it often outcompetes incumbent fossil fuel-power sources. This change is a direct function of identifiable features of the transition – public and private investment and innovation targeting substitute technologies to replace GHG-emitting electricity generation sources. In other sectors and industries, similar features are emerging. While not all industries and companies will be subject to the same pressures, scale or timing of change, virtually all companies will contend with the net zero transition.

A transition plan is the organizational tool to respond to these challenges, articulating how a business will operate and compete within an economy shaped by an inevitable transition to net zero. Strategic integration of the plan helps an organization become resilient and thrive in the economic transition shaped by climate change.

Market forces and regulatory interventions have made the quality and credibility of transition plans a business imperative . Their design and implementation are subjects of increasing attention from investors, regulators, standard setters and other stakeholders who are also managing their own organizational resilience and contribution to the transition. As a result, a range of regulatory frameworks requires organizations to identify key steps and share their plans to transition to net zero.

What is a Transition Plan

Transition plans can demonstrate an organization’s resilience, and its business model’s continued relevance in a net-zero carbon economy, to investors, suppliers, customers and other key stakeholders. Leading companies also use transition plans to show how their business will contribute to net zero by mid-century.

Transition plans may go to the core of the business strategy. For companies in the most emissions-relevant sectors, transition plans should demonstrate how the business’s product-market fit, revenue model and overall strategy align with the evolving demands of a decarbonizing world. These plans must also outline how the company intends to make strategic changes to decarbonize including alterations to their business model and shifting investment priorities.

Transition plans go beyond stated emissions targets. Emissions targets are a popular internal and external accountability tool to focus a business on the climate outcomes of their actions but are only a starting point. When a company reduces its footprint, that change may represent anything from an incremental shift from an evolving relationship with suppliers to a fundamental reshaping of a company’s product and value chain. Transition plans should answer both the “what” and the “how” business transformation is expected to happen.

Transition planning needs to be more than a reporting and compliance exercise. Effective transition requires organizations to be prepared to deliver potentially significant change to their business models and corporate strategies.

Transition plans should go beyond climate. The close interrelation of climate, nature and society increasingly requires organizations to consider future business performance in terms of biodiversity change and impacts on natural and societal ecosystems. Accordingly, organizations may seek to implement business change and integrated transition strategies that are founded on strategic and rounded approaches covering climate, nature and equity.

A regulatory perspective

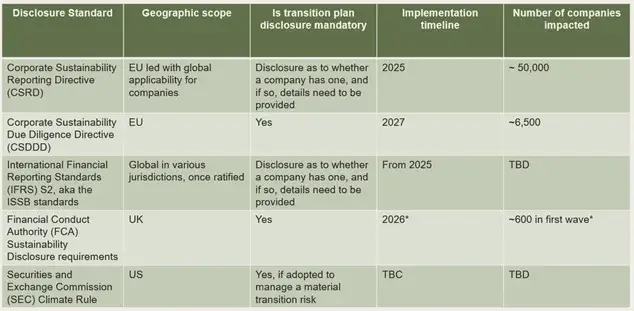

Although transition plan disclosure has been part of voluntary frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) and CDP, regulatory bodies are beginning to formalize standards and require such disclosure.

The EU’s Corporate Sustainability Reporting Directive (CSRD) requires large companies in EU-regulated markets to publicly disclose their climate impact and their plans for addressing it and the Corporate Sustainability Due Diligence Directive (CSDDD) requires companies to adopt, deploy and monitor a climate transition plan and update it annually. In the UK, transition plan disclosures are guided by the voluntary framework of the Transition Plan Taskforce (TPT). Though currently non-mandatory, TPT guidelines offer sector-specific standards for industries like financial services, mining, and utilities. UK policymakers anticipate that TPT’s guidelines may soon become mandatory, especially as businesses face growing pressure to demonstrate credible climate strategies.

Other regions are adopting similar but varied approaches. In the United States, the SEC has proposed rules for enhanced climate disclosures, including disclosure requirements where a company has a transition plan. However, their finalization has been delayed by legal and political hurdles. California has separately created its own disclosure requirements under the Climate Related Financial Risk Act, including the disclosure of a company’s risks and related strategies to adapt to or reduce them.

The International Sustainability Standards Board (ISSB) has introduced global standards that could further harmonize transition plan requirements internationally, yet adoption depends on country-specific regulations. An International Transition Planning Network was also launched at COP29, building on the experience of the TPT.

Table: Overview of transition planning disclosure regulations and standards

What is a Transition Plan

1. Business Change Management – Although what precipitates transition planning may be unique to climate change, business transformation is a familiar feature of corporate management. This area of unlock articulates how a corporate change management framework can provide a familiar structure through which a company can implement the transformation it has identified as necessary in light of the transition to a net zero economy. For example, establishing leadership and accountability or applying robust program management disciplines.

2. Policy Engagement & Advocacy – A company that has committed to a transition plan may rely on certain policy conditions, for its strategy to be successful. Identifying policy needs and engaging government is thus an integral part of executing on a transition plan. This insight considers the role of policy engagement in transition planning, including guidance on identifying policy priorities and implementing strategic approaches to enabling policy change.

3. Finance & Risk – Companies will need to allocate financial resources in order to successfully implement their transition plans. In many instances, businesses will need to adjust their capital plans and engage with the capital markets to adequately fund their own transformation. Building a clear, credible and coherent narrative for their transition priorities and goals, should also communicate the assessment of risk and opportunities underpinning those strategic objectives and associated investment needs is critical. For finance to flow to the priority areas and key projects, a company’s investors and lenders will need to understand these changes to a company’s business case, be comfortable with the commercial viability and see alignment to their own decarbonization-related goals.

4. Value Chain Management – Comp anies will often find that the net zero transition, or social and sustainabili ty factors, have the greatest impact on the company indirectly through their value chain. Companies must focus on value chain awareness, transparency and management, recognizing their position within the value chain and how to respond to and drive the transition across it. This unlock explores key challenges to delivering transition across values chains such as data strategies to enable better understanding and levers (e.g. value chain performance tools, stakeholder engagement and collaboration) to enable and accelerate change.

5. Organizational Capacity – Aligning the company’s management and workforce incentives and capacities with the objectives of a transition plan create the conditions for success execution. This insight identifies how a company can prepare for transition through, for example, building its talent pools and capabilities, upskilling, embedding performance management, enhancing governance