Authors

WBCSD Communications

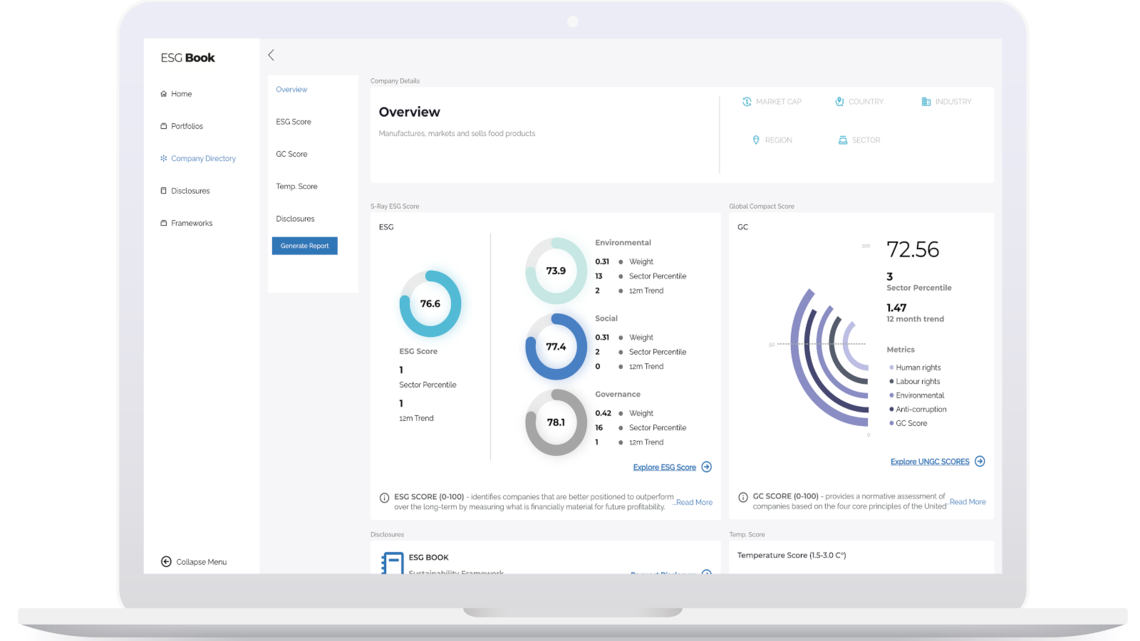

A global alliance of leading financial institutions, investors and businesses have launched ‘ESG Book’, a new central source developed by Arabesque for accessible and digital corporate sustainability information, with the aim of shaping the future of ESG data.

Over $100 trillion of assets under management are today committed to the Principles for Responsible Investment (PRI), while many of the world’s largest public companies have pledged to meet net-zero targets, as sustainability shapes global markets in the 21st century. However, a lack of disclosure, limited accessibility, and inconsistency of ESG data is limiting the acceleration of capital allocation towards low-carbon and sustainable business activities, just when it is most urgently needed.

Supporting the Ten Principles of the UN Global Compact, ‘ESG Book’ makes sustainability data more widely available and comparable for all stakeholders, enables companies to be custodians of their own data through a digital platform, provides framework-neutral ESG information in real-time, and promotes transparency.

“The launch of ESG Book marks the evolution of corporate sustainability. It enables more comparable and higher quality ESG data, thereby advancing the mission of making markets more sustainable,” said Georg Kell, Chairman of Arabesque, “Through a technology-driven approach, Arabesque is committed to making ESG data available to all as a public good.”

Available for all companies, investors, standard-setters, and other stakeholders, ESG Book follows five principles based on a mission to create ESG data as a public good:

- Companies are custodians of their own data

Corporates should have control of their sustainability data by having autonomy over the disclosure and maintenance of data in real-time, unrestricted by the annual reporting cycle. This improves both transparency and market-driven oversight from investors, banks, and business partners, and reduces errors common within the global ESG data ecosystem. - Transparency on data usage and interactions brings more meaningful reporting

Once directly connected to their stakeholders, companies should be empowered to report on the most material and valuable issues requested by investors, thereby reducing the noise in reporting, and enabling data gaps to be more clearly identified. - Accessibility and impartiality

ESG data should be reported by companies in a clear and consistent manner, and be readily accessible for all stakeholders. Similarly, ESG data platforms should support equal access for all in order to promote greater transparency and provide better and more up-to-date information to guide global capital flows. - Framework-neutral

ESG data should be framework-neutral and provide a level-playing field for all market participants, allowing stakeholders to collect and report data based on sustainability questions from multiple frameworks at the same time. It should be adaptable and flexible to respond to a fast-moving market and regulatory environment. - Easing the reporting burden

Reported ESG data can be mapped across a range of frameworks simultaneously over time. For example, if a company discloses CO2 emissions according to GRI, other reporting questionnaires can be populated with the same data. This frees up company resources for greater action-driven insights once the reporting company decides to disclose.

“Alongside a coalition of founding partners, we are excited to launch ESG Book and deliver a new digital solution that connects companies, investors and standard-setters for a more accessible and centralised approach to corporate sustainability information,” said Dr Daniel Klier, President of Arabesque, “Through this platform, we aim to shape the future of ESG data.”

Founding members of ‘ESG Book’ include: The International Finance Corporation, UNCTAD, Global Reporting Initiative, Bridgewater Associates, Swiss Re, HSBC, Deutsche Bank, HKEX, Allianz, Glass Lewis, Cardano Development, QUICK, Bank Islam, Goldbeck, Werte Stiftung, Climate Leadership Coalition, Climate Governance Initiative, Climate Policy Initiative, Climate Bonds Initiative, Responsible Jewellery Council, GeSI, and Arabesque.

For more information and to register your interest in ESG Book, visit: www.esgbook.com