Authors

Maria Mendiluce, WBCSD Managing Director for Climate & Energy, Carine de Boissezon, Chief Sustainability Officer EDF, Keryn James, Group Chief Executive ERM

Everyone was caught out by COVID-19. Despite scientific evidence pointing to a high risk of pandemic, no government or business sufficiently prepared. Those same institutions now need to lead recovery.

How to recover is under debate. As governments deliver enormous stimulus at extraordinary speed, there are calls to return to business as usual and get everything back to normal.

But pre-pandemic life was not normal. It wasn’t normal in March, the 423rd consecutive month of temperatures above the 20th century average. It wasn’t normal in February during Australia’s devastating bushfires, or in November of last year, when Venice suffered its worst flooding in over half a century.

We can’t revert to norms that risk inflicting further harm on people and economies. Choices made now will shape the economic and sustainability agendas for years to come. This moment presents an opportunity for governments and business to change course, shape a greener and more equitable future, and build the resilience required to better manage other systemic risks like climate change.

The looming menace of global warming

Climate change has long been a recognized risk with massive potential implications, dominating the World Economic Forum’s Global Risks Report year after year.

Climate is also the subject of increasing focus from mainstream investors like Blackrock, Vanguard and Morgan Stanley, with the Morgan Stanley Institute for Sustainable Investing labelling climate an “investment megatrend.”

For all this attention, plus ever-growing climate activism, we haven’t been making the progress required to deliver on the Paris Climate Agreement commitment and ideally limit warming to maximum 1.5 degrees Celsius. We must do better.

Green shoots in Europe

There are encouraging signs in Europe, which is making sustainable investment central to recovery efforts.

An open letter from European ministers in early April advocated that the spirit of the European Green Deal be at the heart of rebuilding European economies, stating “The lesson from the COVID-19 crisis is that early action is essential. Therefore, we need to maintain ambition in order to mitigate the risks and costs of inaction from climate change.”

The ‘European alliance for a green recovery,’ launched in April, has gathered support from environment ministers, MEPs, CEOs and business associations, the banking and insurance sector, plus environmental groups, trade unions, and think tanks. Similarly, European leaders at the April Petersberg Climate Dialogue called for climate action to be included as part of economic reconstruction plans following the pandemic, including investments in future-oriented technologies such as renewable energy.

Business is moving

As a path to shape a more sustainable future emerges among European regulators, there is evidence of business leadership taking both COVID and climate into account.

The pandemic has roiled energy markets. Oil has slumped in price, power prices have crashed and CO2 prices for the EU Emissions Trading System have been highly volatile. Energy demand has plummeted, with Italy, Spain, France and the UK all witnessing double digit drops in demand in March.

However, much of the European utility sector, which de-risked its business model after the last financial crisis through investment in low-carbon and regulated assets, has proven to be robust. We have spoken with analysts who attribute relatively stable ratings and the ability of the sector to provide uninterrupted service to investment in low-carbon options and the resilience built by the evolution of their strategies. Ensuring utilities can keep the lights on at an affordable price while continuing to de-carbonize post COVID-19 will require the right market design and long-term incentives, particularly a higher – and more visible – carbon price.

Beyond utilities, business leaders worldwide are stepping up to help fight the pandemic and address climate. In Q1 reporting, Danone CEO Emmanuel Faber said “never before has our One Planet. One Health. frame of action been so relevant, urgent and meaningful.” PepsiCo chose April to join the ~200 companies that have committed to the Business Ambition for 1.5°C, emphasizing that pandemic response and climate change can’t be separated.

In February, April and May respectively, BP, Shell and Total joined the ranks of companies in their industry like Repsol and Equinor commited to achieve net-zero by 2050 or sooner. Still more companies are moving on climate by joining initiatives such as SOS 1.5, RE100 & EV100, and the Science-Based Targets initiative.

Finally, investors have been getting in on the act too, like the 450 organizations responsible for more than USD $40 trillion in assets under management that are signatory to Climate Action 100+, which aims to drive corporate action on climate change and support the recommendations of the Financial Stability Board’s Task Force on Climate-related Financial Disclosures.

From premiums to “greeniums”

During the 2008 financial crisis, government financial system support prevented a global implosion, but excluded measures that might have enabled societies and economies to build back better.

COVID-19 has given us a better understanding of the nature of systemic risks and impacts. Today’s rock-bottom oil price demonstrates what we are likely to see in over-supplied and decarbonizing future energy markets. Assets will be stranded and credit defaults will rise. How will investors and lenders measure the increasing risk and volatility facing fossil fuel investments as compared to low-carbon alternatives? How will they think about the appropriate cost of capital for assets and companies less exposed to climate change and the energy transition? What disruptive innovations will come to lending and investing?

We believe that investments fostering more sustainable outcomes should and will be favored by investors, bankers, regulators and consumers. This will require shifting traditional mindsets and pricing in favor of the pursuit and award of “greeniums” – discounts for borrowers on the cost of capital allocated to low-carbon energy and other sustainability imperatives.

In the second half of 2019, the market showed that new green bonds achieved better pricing than their vanilla equivalents. In its most recent report, The Climate Bonds Initiative reviewed yield curves for 19 green bonds, noting “just three priced with a normal new issue premium. The remainder priced either on their yield curves or with a greenium.”

Investors and banks need to measure projects’ potential social and environmental risk and reward along with their monetary profile. When they do, we will see greenium pricing that rewards investments in the low-carbon economy and de-risks more sustainable projects.

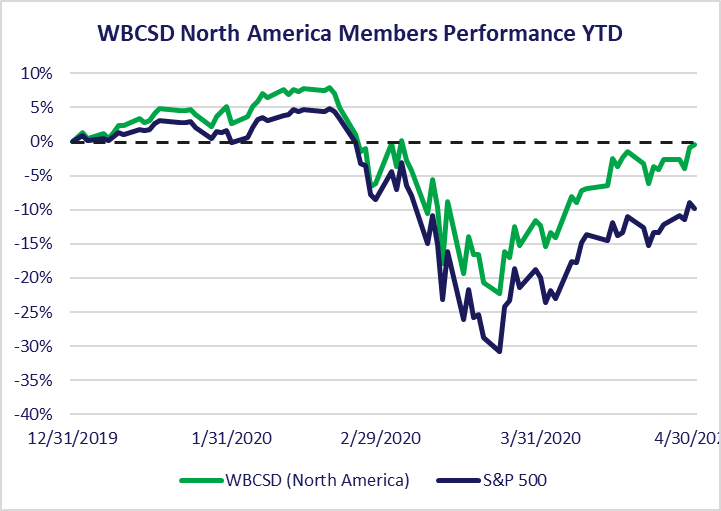

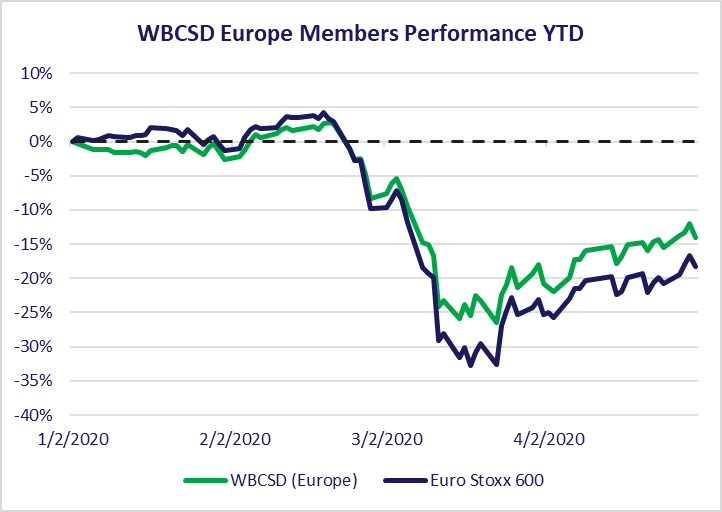

Recent WBCSD data shows strong corporate ESG performers are better weathering the pandemic; companies more able to deal with the coronavirus may also be more resilient to other systemic shocks like climate change. We should hope this is true and back that hope with well-constructed greenium investments that bolster ESG performance more widely in the future.

Stimulating global momentum

Even while we weather COVID-19 and try to anticipate its long-term impacts, there is determination among European governments and global businesses to make sure the recovery is environmentally and socially just. While there are scattered indications of similar sentiment around the world, we also see federal government support for clean energy stalling in the US, and there is concern that governments from Brazil to Southeast Asia may use the pandemic to back away from environmental commitments and enforcement.

Given the immense pressures on governments, and the lack of a uniform view among them on balancing COVID response with progress on the sustainability agenda, it is all the more important that short-term private sector pandemic responses consider the longer-term play that climate change and other sustainability challenges represent. This is happening among companies that recognize that building back better will help them manage future risk and increase resilience, which in turn will incentivize investors and banks to ensure capital reaches more sustainable assets. Companies should be able to self-finance innovation in areas like electric mobility, energy efficiency and smart cities also – actions that might support sustainable recovery with significant job creation.

We all have to recognize that going ‘back to normal’ would mean going backwards. We have had a new, much more widespread understanding of the links between human and economic health and sustainability forced upon us. Let’s seize that, choose redesign over rebuilding, and guarantee a low-carbon future along with a healthy and safe life for all people and the planet.

WBCSD news articles and insights may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Privacy Policy. All Content must be featured with due credits.

Outline