Authors

Inês Amorim, Senior Associate Climate Action, Neal Gray-Wannell, Manager, CCSR, WBCSD

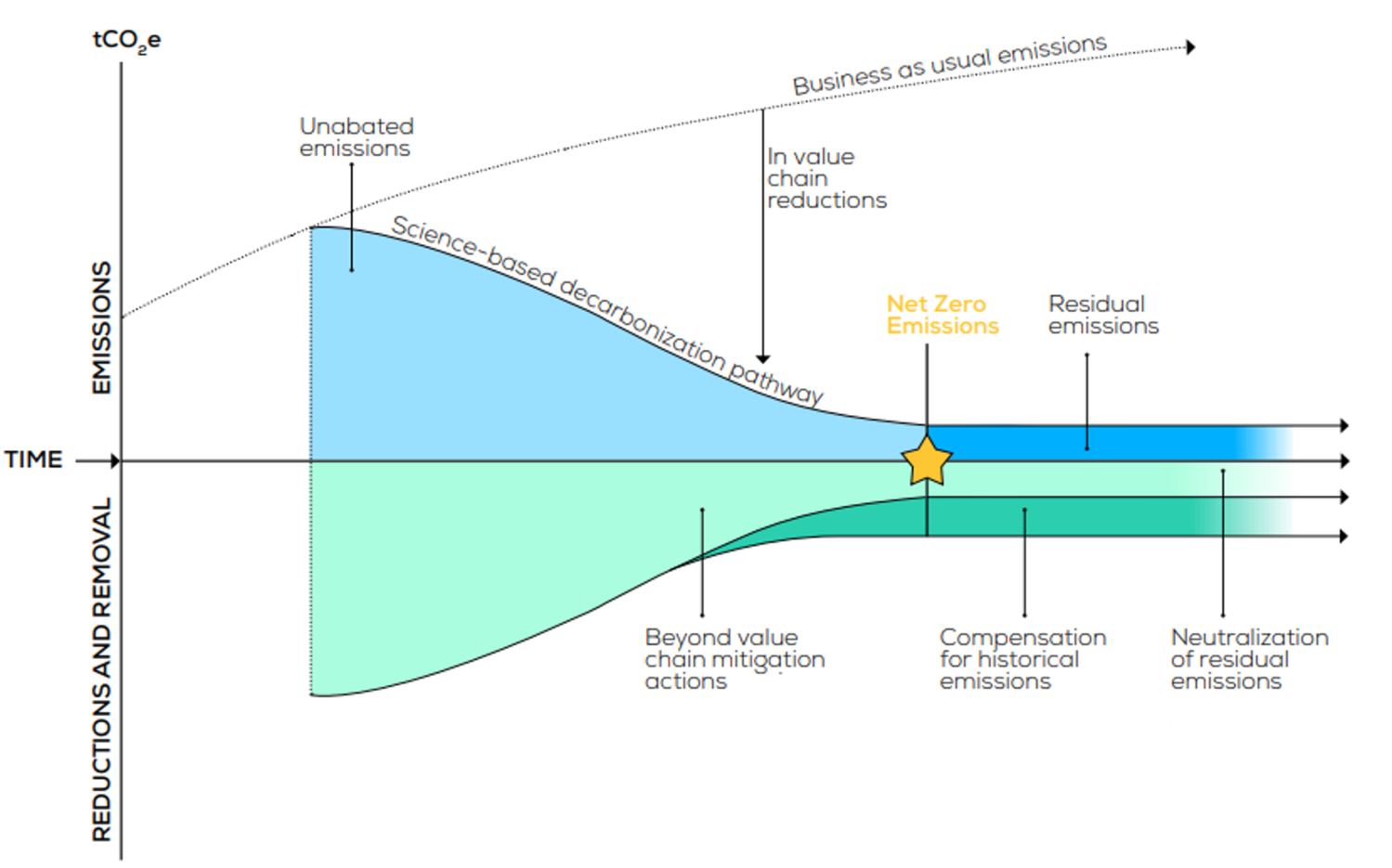

Geneva, 21 December 2022: In the eighth and final session of WBCSD’s Masterclass Series “The Fundamentals of Decarbonization”, we discussed how to counterbalance unabated emissions year-on-year by mitigating beyond the value chain, to further enhance business impact, contributing to a nature-positive, global transformation. While reaching net zero emissions by mid-century in line with science is becoming the standard that societies expect from businesses, companies must effectively manage their unabated emissions along the way, as well as their residual emissions.

Over 40 participants from over 30 WBCSD member companies joined this 90-minute interactive masterclass session supported by a few content experts from the organization. Here are the 5 key takeaways:

Urgent “beyond value chain mitigation” is essential

The Voluntary Carbon Market is a decentralized market, wherein a private entity can purchase and sell carbon credits that represent certified greenhouse gas (GHG) removals or reductions. These credits can be generated through technological solutions, such as Carbon Capture and Storage (CCS), or biological solutions, such as Natural Climate Solutions (NCS) credits.

All businesses must reduce value chain emissions (Scope 1, 2, and 3) within their value chain, consistent with near-term science-based targets (SBTs). High-quality carbon credits can contribute to a company’s journey to Net Zero in four ways:

- Within value chains, companies in the land sector can invest in NCS interventions to reduce their GHG emissions, contributing to their SBTs, while some applications of fossil-CCS are also valid as transitionary emissions reduction solutions (as part of a science-based decarbonization pathway);

- Beyond their value chain, companies can invest in high-quality voluntary carbon credits to counterbalance any unabated emissions year-on-year;

- When approaching their net zero target, companies should ramp up investment in high-quality voluntary carbon removal credits to an equivalent quantity required to fully neutralize unavoidable residual emissions that remain after fully decarbonizing Scope 1, 2 and 3 emissions;

- Go beyond net zero by purchasing and retiring high-quality voluntary carbon credits (and thus compensating for historical emissions).

Adapted from “Natural Climate Solutions and the Voluntary Carbon Market: A Guide for C-suite Executives” (NCSA, 2022)

Across the available net zero guidance (SBTi, ISO Net Zero Guidelines, UNSG HLEG Recommendations), it’s been stipulated that carbon credits can be used to neutralize residual emissions (usually not more than 5-10% of emissions profile). These guidelines and standards also encourage the use of additional investments for beyond value chain efforts.

Integrity is vital to increase credibility and avoid greenwashing

Lack of clarity, inconsistent terminology, and lack of common standards to ensure integrity are some of the many challenges associated with the supply, demand and use of carbon credits. To address these challenges, companies should evaluate factors such as transparency, additionality, permanence, measurability, innovation, impact, and amount of core and co-benefits. Additionally, there are a number of GHG programs and standards such as CORSIA, ICROA, and soon the Integrity Council for the Voluntary Carbon Market, which can credibly validate and verify NCS projects and programs. Furthermore, the Voluntary Carbon Market Integrity Initiative is also currently developing a Claims Code of Practice to guide credible, voluntary use of carbon credits and associated claims.

Projects should have co-benefits aligned with the business strategy

Bayer aims to achieve net zero GHG emissions (including the entire value chain) by 2050 or sooner, having signed the Business Ambition for 1.5°C. Thus, the company prioritizes emissions reductions within their own operations and their supply chain following the mitigation hierarchy before purchasing credits. Nevertheless, recognizing the potential of NCS in tackling emissions while providing benefits to people and nature, the company chooses to: transparently report on strategy and purchases; select suppliers with thorough and standardized due diligence processes; select projects that have co-benefits aligned with the business/ sustainability strategy. According to Bayer, future regulations, market uncertainty in light of Article 6 negotiations, reputational risks, and lack of high-quality projects are some of the challenges that companies can face.

The role of CCS in net zero is “Vital but limited”

Of the available technological solutions available, CCS represents a suite of technologies that can be used to achieve GHG reductions or removals, depending on how it’s applied. CCS as a GHG reduction tool has a critical ‘transitionary’ role for the hard-to-abate industrial sectors. The Energy Transitions Commission recently published a report where CCS was labeled as “Vital but Limited” to this effect. Whilst hydrogen may become a competing technology for some high-temperature applications, there are currently no other viable solutions for cement and some chemical processes. The IPCC predicts the energy transition would be 138% more expensive without CCS. On the other hand, CCS-based removals, such as Direct Air Capture and Storage (DACCS) are some of the most durable available. Durability is a measure of permanence and the risk of reversibility from the carbon store. Highly durable removals are essential for neutralizing fossil emissions and ultimately achieving a geologic/biogenic carbon balance at net zero.

Whilst there are clear techno-economic barriers to CCS deployment, there also remain some issues of perception. Regarding long-standing concerns over storage integrity, the IPCC predicts storage integrity will very likely exceed 99% over 100 years and likely 99% over 1000 years. Furthermore, CCS has been working safely and effectively since the 1970s for Enhanced Oil Recovery and there is room for significant cost savings through learning and innovation to improve its economic viability. It is also true that carbon capture efficiency will never be 100%, though efficiency is ever-increasing with new projects targeting efficiencies between 90 and 95%.

There is a credible risk that an indefinite use of CCS for fossil emissions increases the risk of carbon lock-in, meaning that crediting programs need to have stringent controls to mitigate this. CCS for fossil emissions should only be used as a transitionary technology in select applications for an immediate reduction in emissions, thus not resulting in an incentive to continue the indefinite operation of such plants. Whilst technological removals can often seem too good to be true, they can place significantly increased demand on resources, such as water and available renewable electricity. Carbon crediting programs can ensure that risks are adequately assessed.

Both nature-based and technological solutions are needed across a diverse portfolio of solutions

NCS and technological solutions are both critical for mitigating climate change. Solutions are often divided into either nature or technology due to fundamental durability differences. This is not always constructive as this can disincentivize less durable, but still critical mitigation solutions. A portfolio approach to investing in a diverse range of credits across both nature-based and technological removals allows synergies and trade-offs between the different solutions to be embraced. Investment across a diverse range of solutions will allow nature-based solutions to provide mitigation in the short-term whilst technological solutions are developed to the level where they can credibly neutralize residual emissions at net zero.

Further guidance for companies:

- The role of Nature-based Solutions in strategies for Net Zero, Nature Positive and addressing Inequality

- A Buyer’s Guide to Natural Climate Solutions Carbon Credits

- Carbon Capture, Utilization and Storage in the Energy Transition: Vital but Limited

- Beyond Value Chain Mitigation FAQ – SBTi

WBCSD is currently developing a framework to objectively assess and compare different removal solutions to inform the creation of a diverse portfolio of solutions, as well as the developing portfolio guidance for mitigation beyond the value chain.

For any questions on the Masterclass series, please reach out to sos15@wbcsd.org

WBCSD news articles and insights may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Privacy Policy. All Content must be featured with due credits.

Outline