Authors

Matt Inbusch, Senior Manager, Nature and Land Use, Pathways, WBCSD & Pauline Peek, Communications Lead Agrifood & Biodiversity at Metabolic

Our global agri-food system faces an unprecedented challenge. It’s responsible for about a third of global greenhouse gas emissions and uses roughly 70% of freshwater, driving significant biodiversity loss and land-use change. With projections indicating a 50% increase in food demand by 2050, the system represents a substantial threat to our natural world. At the same time, the agri-food system could be the key to reversing nature loss, presenting a monumental opportunity for positive change.

The Global Biodiversity Framework aims to halt and reverse nature loss by 2030, a global goal around which our agri-food value chains can and should align. This transformation requires rethinking how we produce, source and consume agricultural products, as well as how we’ll balance the risks and opportunities inherent to our relationship with nature.

Nature-related frameworks and standards – both voluntary and regulatory – are proliferating, increasing the pressure on corporates, individuals and farmers alike. In light of all this, more and more companies are seeing the value of developing a robust nature strategy.

Two complementary publications from Systemiq and Metabolic and WBCSD show how businesses can incorporate a strategy for nature solutions. It is best designed and implemented with materiality at its core (top-down), yet it should be approached with deep consideration of local context (bottom-up) in order to drive coordinated actions and outcomes toward a nature-positive world.

Nature at the heart of business

When it comes to agri-food value chains, integrating sustainability into business plans is a strategic imperative that cannot be ignored. Going beyond carbon and acting on nature loss is key.

Why? To start with, nature loss and climate change are not separate issues. Climate change drives nature loss and nature loss in turn drives climate change. Sustainability strategies should reflect this interconnectedness if they are to succeed. The white paper, “Nature Risk is Business Risk – The Best Companies Manage Both,” co-authored by Systemiq and Metabolic, underscores the fundamental importance of this issue.

Focusing on nature doesn’t just ensure the integrity of a sustainability strategy; it’s also a way of protecting businesses against significant physical, regulatory and financial risks. After all, approximately 44 trillion USD of economic value generation (over half of the world’s GDP) is moderately or highly dependent on ecosystems and their services such as pollination, water quality and disease control. Nature loss can cause disruptions in supply chains and escalate costs. UNEP estimates that the decline in pollinators alone puts 577 billion USD worth of crops at risk annually.

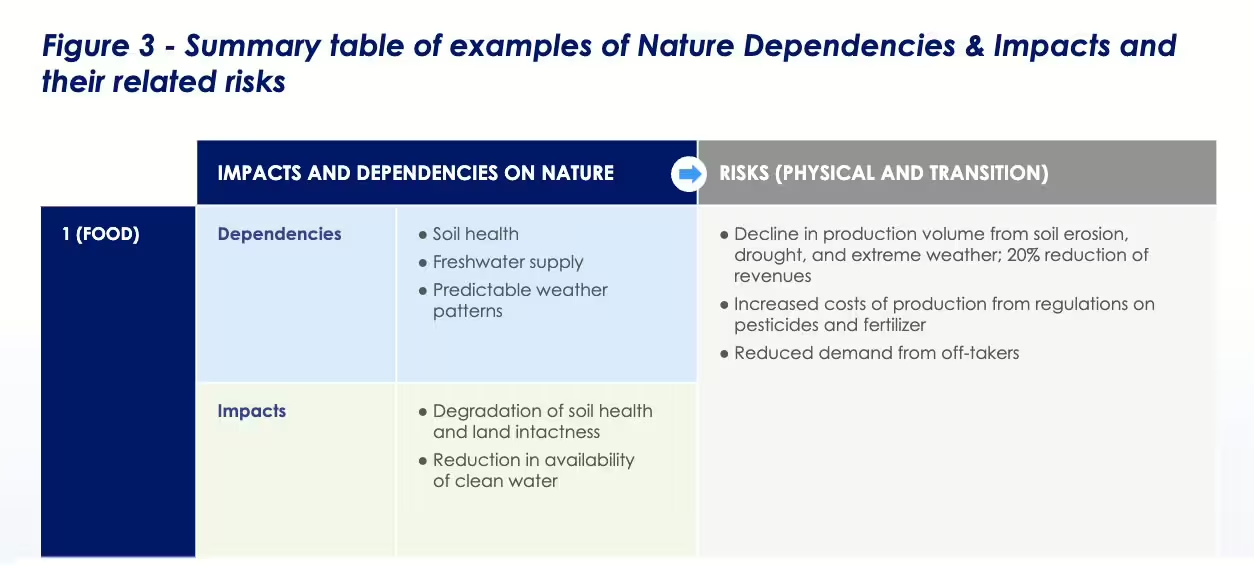

Examples of nature impacts, dependencies and their related risks for a hypothetical beverage company. From ‘Nature Risk is Business Risk – the Best Companies Manage Both’:

The key for corporate actors right now is to get clarity on what share of that 44 trillion USD is in their value chains and act on it accordingly. But what does it look like to do that? Start with taking risks and opportunities seriously. Nature-focused frameworks, including SBTN, IFRS and TNFD, offer a helpful starting point.

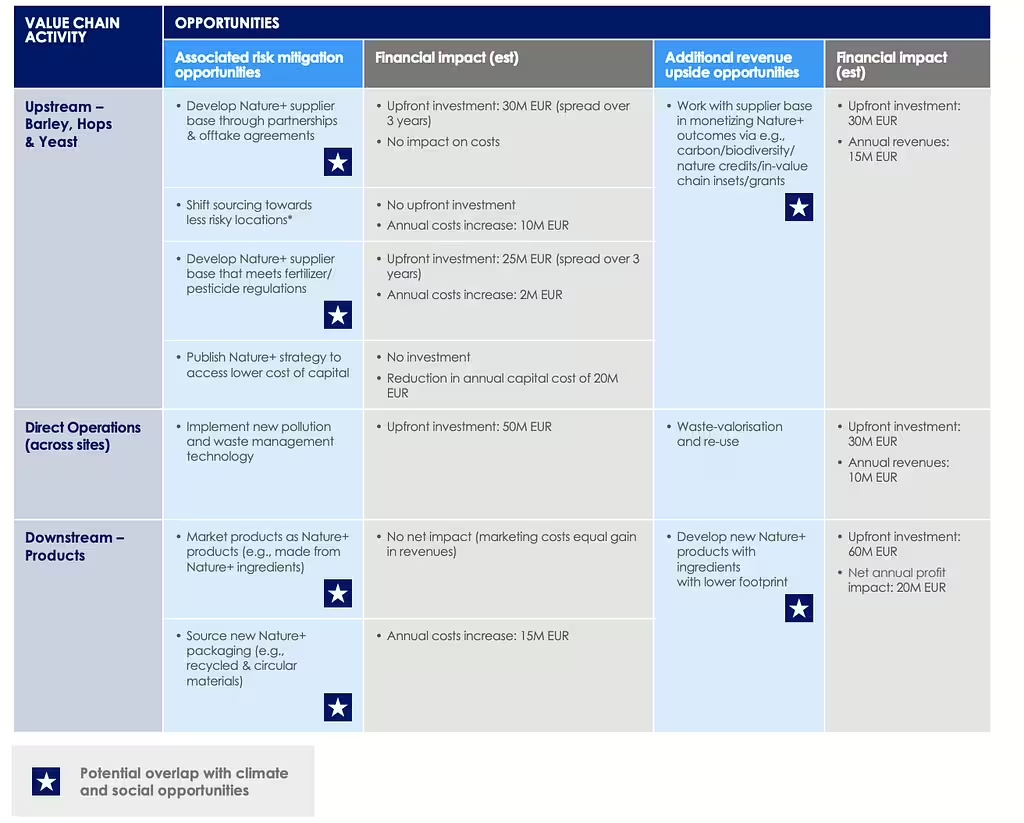

Financializing nature-related risks and monetizing the opportunities opens the door to harmonizing the entire business model with existing sustainability goals. Indeed, CSOs across sectors have been fighting for years to integrate sustainability beyond their department, because they know that creating an effective nature-positive strategy demands a comprehensive business approach. It demands commitment across areas such as procurement, production, sales and even the accounting department.

Nature-related opportunities and their estimated financial impact for a hypothetical beverage company. Graphic developed by Systemiq from ‘Nature Risk is Business Risk – the Best Companies Manage Both’:

By following guidance from frameworks like ACT-D and the TNFD, businesses can systematically assess and integrate nature-positive actions into their strategic planning, translating corporate ambitions into actionable insights at the landscape level. This not only aligns with global initiatives like the Global Biodiversity Framework, and the Nature Positive Initiative but also translates into tangible business benefits. Proactive nature management enables companies to navigate the evolving policy landscape, identify critical actions to mitigate negative impacts and unlock new markets and opportunities for revenue and margin growth.

Top-down and bottom-up approaches

WBCSD’s Roadmap to Nature Positive for the agri-food system provides “how-to” corporate guidance for credible, impactful nature action to support the global goal for nature. This includes identifying the most significant dependencies, impacts, risks and opportunities (DIROs) for companies up and down the value chain, which inform priority actions where business can – and must – lead today. Beyond this roadmap, WBCSD provides landscape deep dives illustrating nature-positive approaches across specific global contexts and crop systems.

WBCSD’s Roadmap to Nature Positive highlights priority actions for unique agricultural landscapes, customized for different entry points along the corporate nature maturity spectrum.

WBCSD has engaged its member companies and partner organizations in this work, including deep research and stakeholder interviews at the local level. So what have we learned?

All nature is local

Agri-food value chains are complex, involving diverse commodities and many tiers of suppliers. Corporates should begin with a sector-level screening to understand their material nature-related DIROs; there are numerous tools to help here. But the next step is critical: assessing a company’s own operations and value chains, both up- and downstream. For corporates sourcing from, supplying to or financing agri-food value chains, this yields important considerations for determining the right solutions to invest in, where, and how.

For example, in the Cerrado region of Brazil, we found that the most critical pressure on nature is land-use change – the clearing of forests and native vegetation – which has a significant carbon and environmental footprint in this biodiversity hotspot. Other impacts are more nuanced; as the soy-based system is mostly rainfed, water use is a relatively lower pressure driver here compared with the sector at-large. But this is changing: the massive scale of soy plantations is affecting the microclimate, raising local temperatures and decreasing rainfall. Corporates with a stake in the region must address these risks in order to protect their supply chains and the local environment.

Farmers at the center

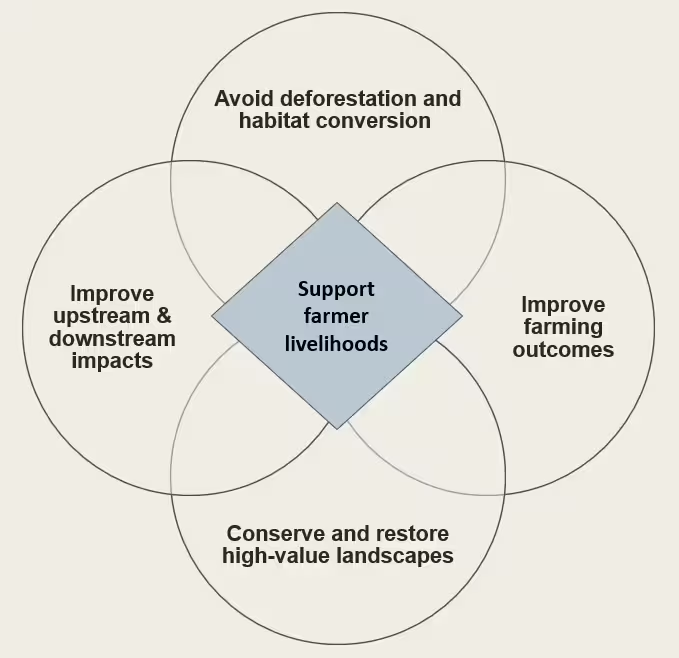

Wherever a company sits in the agri-food value chain, all roads point to the farmers. For example, regenerative agriculture can help restore soils, sequester carbon and save water in diverse landscapes across the world. But farmers need incentives that reward them for improving practices. Agri-food companies must take the lead here, in collaboration with policymakers, banks, and retailers. As one biodiversity expert (and lifelong corn farmer) in Minnesota told us, “If we build the markets, farmers will plant [the cover crops]!” Localized farmer support – both financial and technical – is especially critical in landscapes dominated by smallholders, such as the rice production system in Vietnam’s Mekong Delta.

Priority actions for agri-food system transformation can only succeed with farmers at the center (figure adapted from WBCSD’s Nature Positive Roadmap for the agri-food sector).

Perfection vs progress

The nature-positive space is dynamic; frameworks, regulations, methods and data continue to evolve in real time. But corporates already have the tools and knowledge to invest in landscape-appropriate solutions addressing the biggest nature-related pressures in their value chains. WBCSD’s roadmap highlights diverse examples of companies and partners driving nature-positive outcomes today – and sharing their lessons along the way.

Building a nature-positive future, together

Nature is at the heart of the agri-food system; the companies that recognize this and act accordingly are securing their place in a nature-positive future. This involves setting nature-related goals aligned with broader sustainability objectives, integrating nature into corporate strategy and functions, and delivering sustainable outcomes on the ground. Wherever a company sits on the nature journey, it’s crucial to recognize that while nature’s complexity varies locally, this shouldn’t deter science-driven, collaborative action. Begin by addressing the most material issues, linking global objectives to local actions, and centering on producers. Then, start or scale these efforts without delay.

Through this process, corporate actors can gain valuable insights that will form a robust foundation for a nature-positive strategy and help facilitate collaboration throughout the value chain. Embrace this journey by sharing experiences transparently via annual reports, case studies, and public events, as collective learning is essential for advancing the nature space. Together we can build a future where nature and people thrive.

For further guidance, please reach out to WBCSD or Metabolic.

Outline