Authors

Peter Bakker

It is remarkable how the agenda in this 50th edition of the World Economic Forum (WEF) Annual Meeting has shifted towards calling for a move to stakeholder capitalism, as issued by Klaus Schwab in the new Davos Manifesto. The theme of the 2020 forum itself is: “Stakeholders for a Cohesive and Sustainable World”.

How do we get there in a capitalist world?

For the first time in the history of WEF’s Global Risk Report, environmental risks dominate the top 5 most likely and impactful risks. Climate, inequality and biodiversity are now top on every business leader’s mind.

Yesterday, a second important input was issued: the annual Edelman Trust Barometer report, showing that trust in institutions continues to be under pressure, driven by the fear for the future of work and inequity. What also jumps out is the fact that 56% of the respondents think that “capitalism as it exists today does more harm than good in the world”.

All this to point out that a radical transformation of our economic systems is now inevitable. The energy system needs to decarbonize; the food- and land-use system needs to stop the destruction of nature and provide healthy food for all; we need to move to a circular economy that strives for zero waste; we need to ensure we meet the basic needs of all people on this planet; and we need more liveable and greener cities. Most importantly, the capitalist system needs to give better incentives – the cost of capital should be lower for companies and assets that achieve the transformations that people and the planet need.

As I have argued in my earlier “Garbage in, garbage out: systems transformation in a capitalist world” blog, I do not believe that capitalism itself is the challenge. The conversation needs to focus on how we redirect capitalism to truly accelerate the required transformations now.

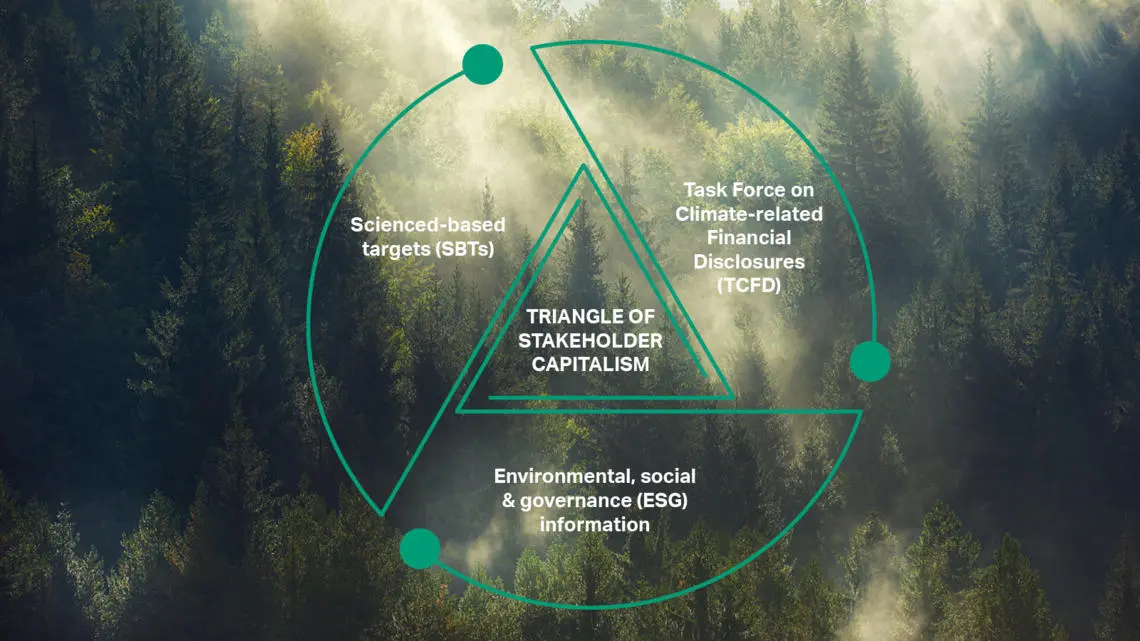

The fix is relatively simple and I would call it the Triangle of Stakeholder Capitalism:

- Science-Based Targets (SBTs): the SBTs for climate and biodiversity are now clear: net-zero carbon by 2050 and net-zero loss of nature by 2030 – business needs to focus on creating the pathways both individually and collectively in sectors and along value chains.

- Task Force on Climate-related Financial Disclosures (TCFD): the TCFD recommendations are the most important and transparent leverage to link the big environmental risks to company decisions and capital market valuations. For further impact and change, the TCFD recommendations need to expand its scope – TCFD+, going beyond just climate to include nature and biodiversity loss – and be made mandatory for all businesses everywhere. This will accelerate the speed and scale of transformation faster than any other measure.

- Environmental, Social and Governance (ESG) information: we need to urgently push for standardization of the ESG information that all companies will use in their disclosure to investors and other stakeholders. The current fragmentation of KPIs, reporting frameworks, surveys, ratings and benchmarks, makes comparability of information impossible and thus ineffective. The work that the WEF is doing on ESG standardization should be the start of a revolution in the corporate reporting space. Fewer indicators that are materiality-based and aim to create comparability will enhance the capital market inclusion.

I am urging all business leaders in Davos and beyond to embrace the new norm of signing up to clear targets and using a common language for our reporting.

Simple accounting rules around meaningful ESG indicators – driving the risk assessment, strategic scenario building and management decision-making like TCFD is doing – towards the delivery of the science-based targets, will make Capitalism drive us towards the sustainable world that will serve all people and protect our planet.

WBCSD news articles and insights may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Privacy Policy. All Content must be featured with due credits.