Climate change and intensive agricultural practices increasingly threaten supply chain resilience and the livelihoods of farming communities in Europe and beyond. To address these challenges, progressive value chains actors, governments, financers and farmers are turning to regenerative production systems. Central to this transition is the growing emphasis on transition finance and investment to support in adopting regenerative agriculture transitions, ensuring sustainable production within planetary boundaries.

This report, developed collaboratively by OP2B, Deloitte, PepsiCo and Unilever, investigates the economic impact of transitioning to regenerative agriculture at the farm level. It catalogs available incentives, highlights the financing gap farmers face across 34 unique combinations of 12 crops in 10 European countries, and provides actionable recommendations for food systems actors.

The report includes findings on the farmer business case and funding needs for transitions to regenerative agriculture as well as insights into existing incentives:

Farmer business case and funding needs:

- Based on our research, we found that the farmer business case (Net Profit Impact) for implementing the six most common regenerative agriculture practices is positive after 3 to 5 years for all farm sizes versus conventional practices (for the crops in scope of this study). The main drivers of higher profitability are projected yield increases and reduction of costs.

- We encountered differences in profitability which can mostly be explained by crop types, rotation schemes, farm sizes, and stage of transition to regenerative agriculture practices. Profitability is higher for high yield density crops (such as potato, tomato), for crop rotations and for large farms (>55ha). For similar crops grown across countries, variation in profitability is mainly due to differences in average farm sizes, but is also influenced by yield, crop prices and input costs.

- Especially small and medium-sized farms can only reach a positive business case by taking prudent investment decisions (e.g., equipment sharing or use of agricultural services to limit investments in equipment) and alternating with more profitable crops in rotations. These farmers need support to manage the transition profitably.

- Irrespective of the Net Profit Impact, farmers are confronted with significant investments before implementing regenerative agriculture practices. According to our research, upfront investments range from ~€2000/ha to ~5000/ha (pre-incentives) depending on the farmer’s decisions to buy or share required equipment or use agricultural services. When these upfront investments are accounted for, payback period for farmers is approximately 9 years, with a ~4% 10-year IRR5 (p.a.) only, even with investments on the lower end of the range.

Existing incentives

- When looking at the available incentives, we can conclude that there are not sufficient incentives available to cover the costs of the transition at farm level: By applying available incentives, the payback time can decrease from 9 years to 5 years. However, farmers will still have a funding need between ~1400 to 4100 €/ha (post-incentives) depending on the extent of investments made.

- Also at a macro-level, there is a significant funding gap with only ~2 to 6% of total funding needs for a transition to regenerative agriculture practices in arable farming in Europe currently being covered. We however encountered differences in incentives identified between countries in scope with a greater number of incentives identified in countries such as UK, Germany and France, and fewer incentives for regenerative agriculture identified in Serbia, Greece, Turkey and Poland.

- Moreover, we found that current incentives are not fit-for purpose. They focus mainly on supporting ongoing costs rather than the much-needed funding for upfront investments, and are often not built around specific farmer needs and desired outcomes of the regenerative agriculture practices, leading to undesired consequences such as mono cropping.

- Finally, we have also observed a lack of transparency and access to incentives, as well as a lack of accountability to monitor and steer the incentive landscape for implementing regenerative agriculture practices across Europe.

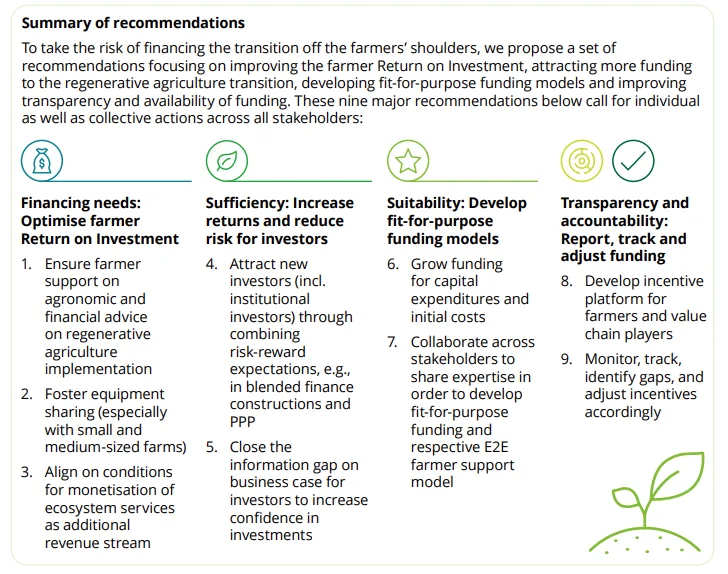

As a result of the report’s analysis, the report recommends the following:

Outline